From One Property to a Portfolio:

How to Scale Without the Stress.

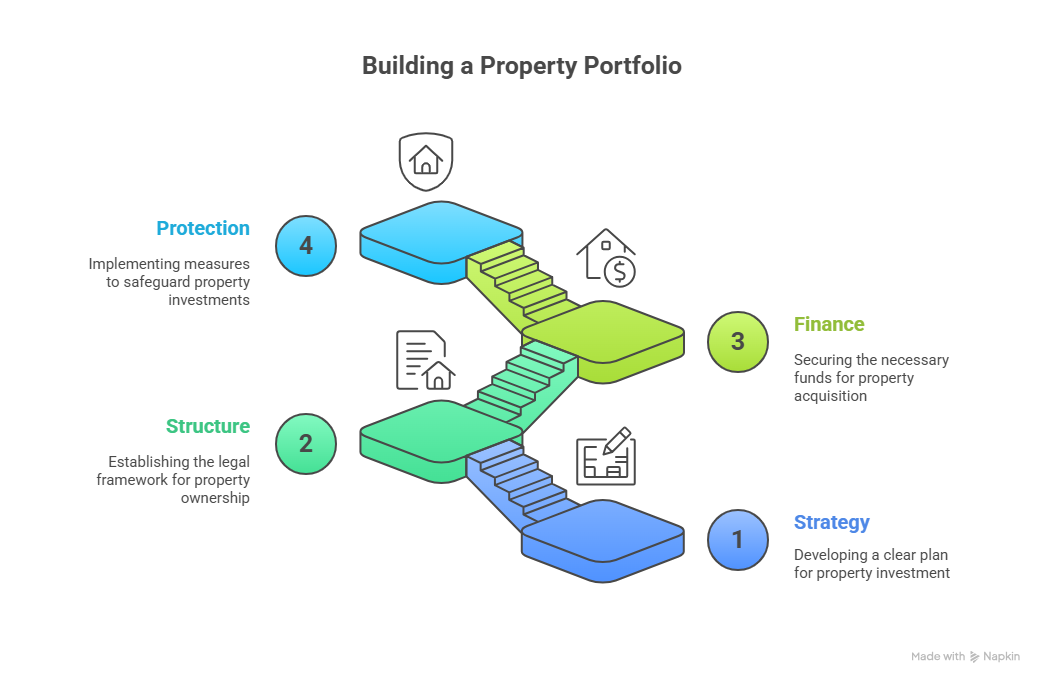

Scaling from one rental to a thriving portfolio takes more than luck; it’s about strategy, structure, and smart financing. Here’s how successful landlords are building long-term property businesses in 2025 and beyond.

Step 1: Know Your Numbers Before You Grow

Every successful portfolio starts with one thing: understanding your figures.

Before expanding, calculate:

Net rental yield – rent minus all costs ÷ property value.

True cash flow – after tax, insurance, maintenance, and mortgage.

Loan-to-value (LTV) – how leveraged you are.

Stress-test margin – can your rents still cover mortgage costs if rates rise again?

When you understand your baseline, you can safely model how additional properties will affect your monthly income and borrowing capacity. We can work with you to build a portfolio picture and guide you through your next steps.

Step 2: Structure It Right

Once you move past one or two properties, personal ownership becomes inefficient.

That’s where limited-company SPVs come in.

Why use an SPV?

Tax efficiency: Mortgage interest remains fully deductible.

Reinvestment flexibility: Retain profits to fund new purchases.

Liability separation: Each property or SPV ring-fences risk.

Professional credibility: Lenders treat SPV investors as commercial borrowers.

Step 3: Finance for Growth

Financing multiple properties means thinking beyond single buy-to-let mortgages.

That’s where portfolio landlord mortgages and refinancing strategies come in.

Portfolio loans allow one facility to cover several properties.

Equity release lets you pull capital from existing holdings to fund deposits.

Cross-collateralisation enables you to balance strong and weaker-yielding assets.

Specialist lenders often provide bespoke underwriting for complex portfolios.

Step 4: Master Cash Flow Planning

Cash flow is the lifeblood of scaling. The investors who thrive through every cycle are the ones who plan liquidity carefully.

Key habits:

Keep emergency reserves equal to at least 3–6 months of portfolio costs.

Diversify your product mix — some 2-year fixes, some 5-year, to stagger maturities.

Stress-test your portfolio regularly using our ICR calculator.

Step 5: Follow a Clear Roadmap

Success comes from a repeatable process. Here’s a proven six-step path many of our investors follow:

Assess – Review your equity, yields, and goals.

Plan – Decide how fast to scale and what areas suit your strategy.

Structure – Choose personal or SPV ownership.

Finance – Line up pre-approvals and portfolio lenders.

Acquire – Target high-yield or value-add properties.

Protect – Secure income, assets, and family wealth.

Step 6: Protect What You Build

Scaling increases both your income and your exposure. Protecting your portfolio means more than building maintenance — it’s about personal and business continuity.

Consider:

Life cover to clear debt if something happens to you.

Income protection to maintain repayments if you can’t work.

Key person or shareholder protection for company directors.

We can help structure this for you to protect you and your family.

Our Take

Building a portfolio isn’t about collecting properties, it’s about creating a resilient business that performs through every cycle. The smartest landlords are scaling deliberately, structuring professionally, and protecting intelligently.

When you know your numbers, keep liquidity, and leverage expert advice, expansion stops being stressful and starts being strategic.

Next Steps

Thinking about scaling your portfolio or refinancing to release equity?

👉 Book a free portfolio review with our team — we’ll help you map out a step-by-step strategy tailored to your goals and risk profile.

Manchester Independent Mortgages Ltd is authorised and regulated by the Financial Conduct Authority (FCA 431647).The information above is for guidance only and does not constitute personal advice. Your home may be repossessed if you do not keep up repayments on your mortgage.