Protecting Your Portfolio:

Insurance and Life Cover Landlords Overlook

You’ve worked hard to build your property portfolio, but would it survive without you? Here’s how the right insurance and protection can safeguard your assets, income, and family against life’s unpredictable risks.

Why Protection Matters as You Scale

Most landlords spend hours comparing mortgage rates or yields, but far fewer think about what would happen if illness, injury, or worse stopped them from managing their portfolio.

You wouldn’t leave a property uninsured against fire or flood, so why leave your income or your family’s financial future unprotected?

In 2025, the smartest investors aren’t just focusing on growth, they’re focusing on preservation.

1. Landlord Insurance – The First Line of Defence

Landlord insurance is often a tick-box exercise, but it’s worth revisiting your policy regularly.

Coverage gaps can quickly turn a good investment into a financial burden if disaster strikes.

Key types of landlord insurance

Buildings insurance: Covers damage from fire, flood, or structural failure.

Contents insurance: Protects furniture and fittings in furnished lets.

Loss of rent cover: Pays out if your property becomes uninhabitable.

Legal expenses cover: Handles disputes with tenants or contractors.

Public liability insurance: Protects against injury claims made by tenants or visitors.

Pro tip:

When your portfolio grows, consider a portfolio-wide policy rather than multiple single-property ones — it’s often cheaper and easier to manage.

2. Mortgage Protection – Securing the Debt

If you have mortgages on your rental properties, mortgage protection ensures the debt is repaid if you die or suffer a critical illness.

Think of it as your portfolio’s financial seatbelt — something you hope never to use, but essential if life takes an unexpected turn.

How it works

Pays off or reduces your mortgage balance in the event of death or serious illness.

Prevents loved ones or business partners from inheriting debt.

Can be structured to cover multiple properties or company debt.

This is particularly important if your properties are owned in a limited company. Directors can take out business loan protection to cover company borrowing — ensuring the business can continue without financial strain.

3. Income Protection for Landlords

For self-employed landlords or those relying on rental income, income protection can provide monthly payments if illness or injury stops you working.

While tenants’ rent may still come in, managing your portfolio and maintaining finances can quickly become challenging without a steady personal income.

Why it matters

Covers up to 60% of your regular income.

Pays monthly until recovery or retirement (depending on plan).

Provides stability while ensuring mortgage and property costs are covered.

Many landlords overlook this, assuming rent alone will sustain them. But with repairs, voids, and admin costs, the buffer can disappear fast.

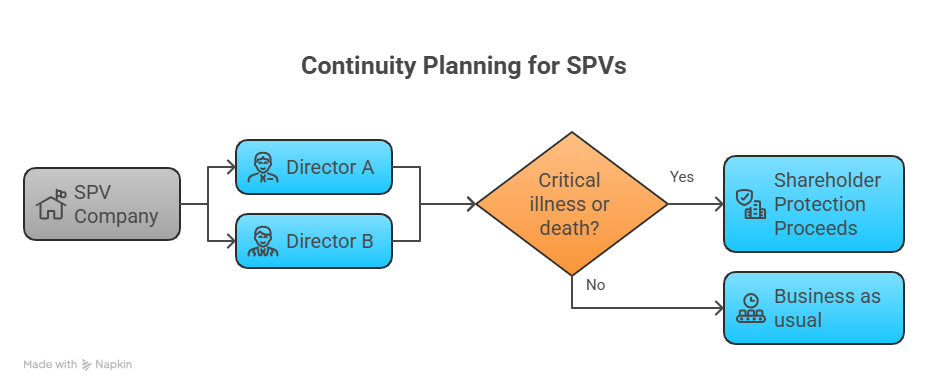

4. Business and Shareholder Protection for SPV Directors

If your portfolio sits within an SPV or holding company, you may share ownership with family or business partners.

Shareholder protection or key person insurance ensures continuity if one director dies or becomes critically ill.

Pays out to the remaining directors or company to buy back shares.

Prevents unwanted external ownership or financial disputes.

Keeps the business solvent and within the intended circle of control.

The premiums can be paid by the company before tax.

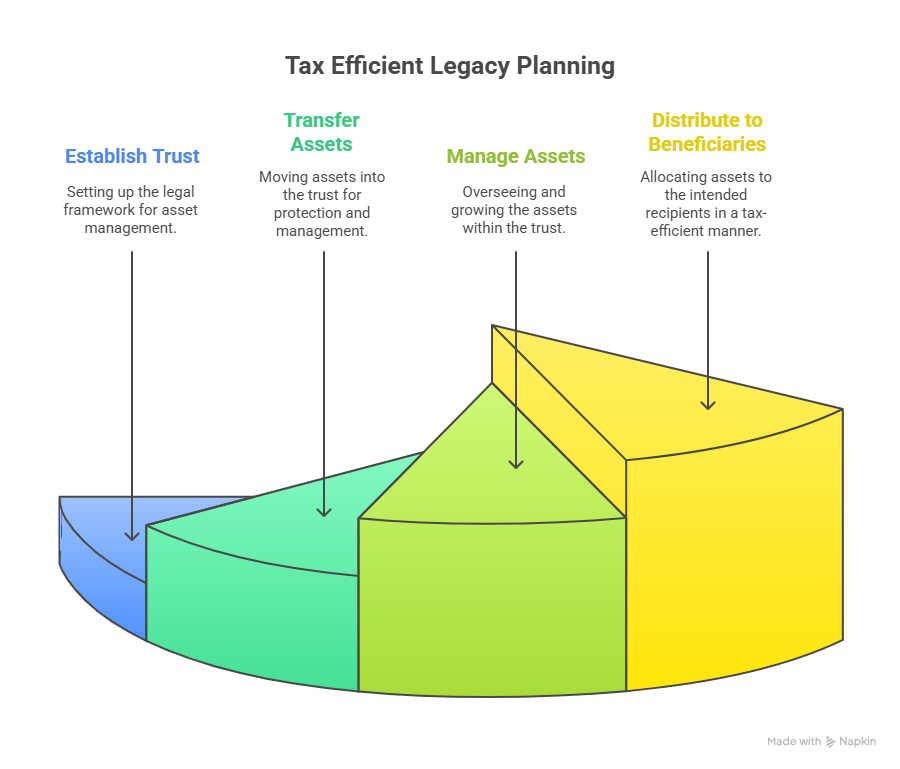

5. Estate Planning and Legacy

For landlords with long-term wealth goals, integrating life cover with estate planning is vital. Life policies written into trust can pass proceeds directly to beneficiaries, bypassing probate and reducing inheritance tax exposure.

It’s the final piece of the portfolio-protection puzzle: ensuring your years of investing become a legacy, not a liability.

Our Take

Property investing is about more than generating income — it’s about safeguarding the life you’ve built.

Too often, landlords underestimate their exposure: one illness, one loss, one uninsured event can undo years of work.

But with the right combination of insurance, protection, and trust planning, you can protect your family, your income, and your business simultaneously.

Protection isn’t a cost — it’s peace of mind, and an integral part of long-term wealth preservation.

Next Steps

Not sure which protection options fit your portfolio?

Book a free portfolio review with our team — we’ll help you assess gaps in your cover and build a tailored protection plan that complements your investment strategy.

Manchester Independent Mortgages Ltd is authorised and regulated by the Financial Conduct Authority (FCA 431647). The information above is for guidance only and does not constitute personal advice. Your home may be repossessed if you do not keep up repayments on your mortgage.